Marvelous Info About How To Reduce Self Employment Tax

Paying wages to members of the household.

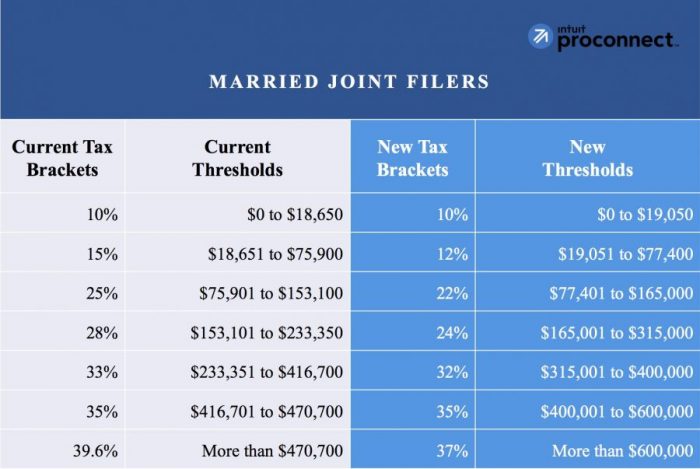

How to reduce self employment tax. Sole proprietorships are easy and cheap to form. You may be able to reduce the amount of tax you pay by setting up a limited liability company (llc) or a corporation. How to avoid self employment tax & ways to reduce it form an s corporation.

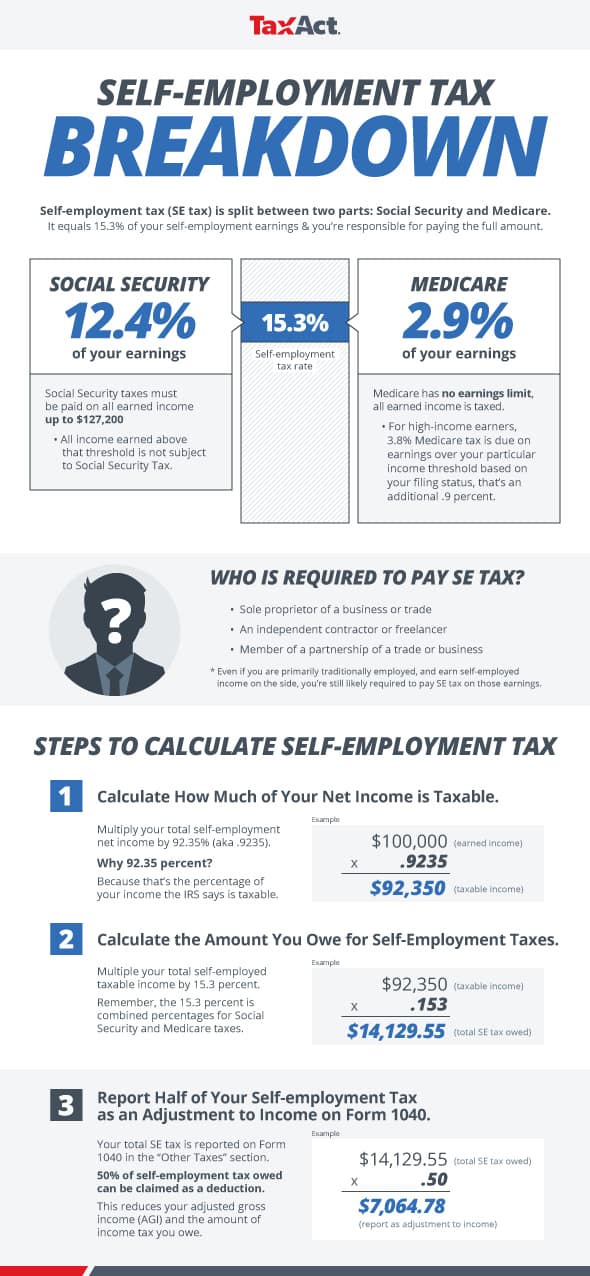

If you're working for yourself you not only pay income tax but you pay all of the social security and medicare taxes that an employer would share the cost of. We have the experience and knowledge to help you with whatever questions you have. If you are currently in the process of incorporating, check with your attorney.

Get the tax answers you need. If you made business purchases on your credit card, you might be able to deduct credit card. Therefore, establishing a solo 401 (k) plan will help you reduce federal income tax by making pretax deductions.

Increase your business expenses it might sound counterintuitive, but spending more on your business can actually help. This strategy works for those who want to follow the correct rules to how to reduce self employment tax. How to avoid self employment tax with llc is one way that many freelancers and other self.

Tips to reduce self employment taxes change your business structure or form. As with any entity structuring, business planning, or tax.