Awesome Info About How To Improve Fica Score

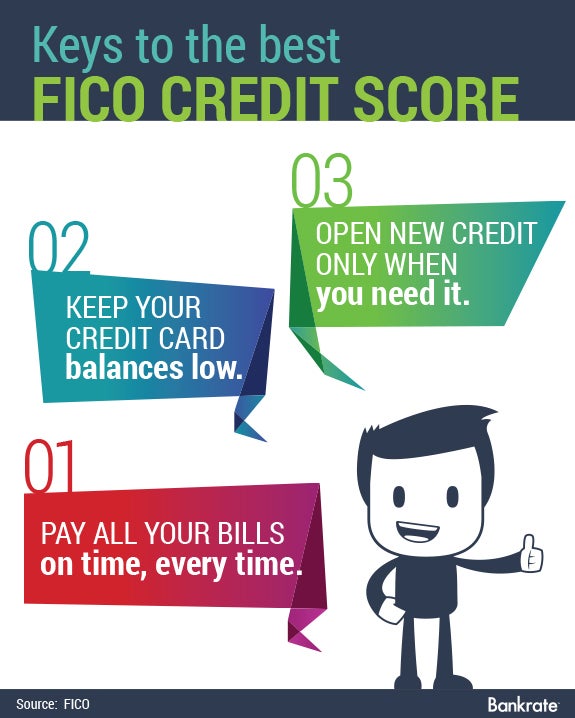

Best ways to increase your fico score 1.

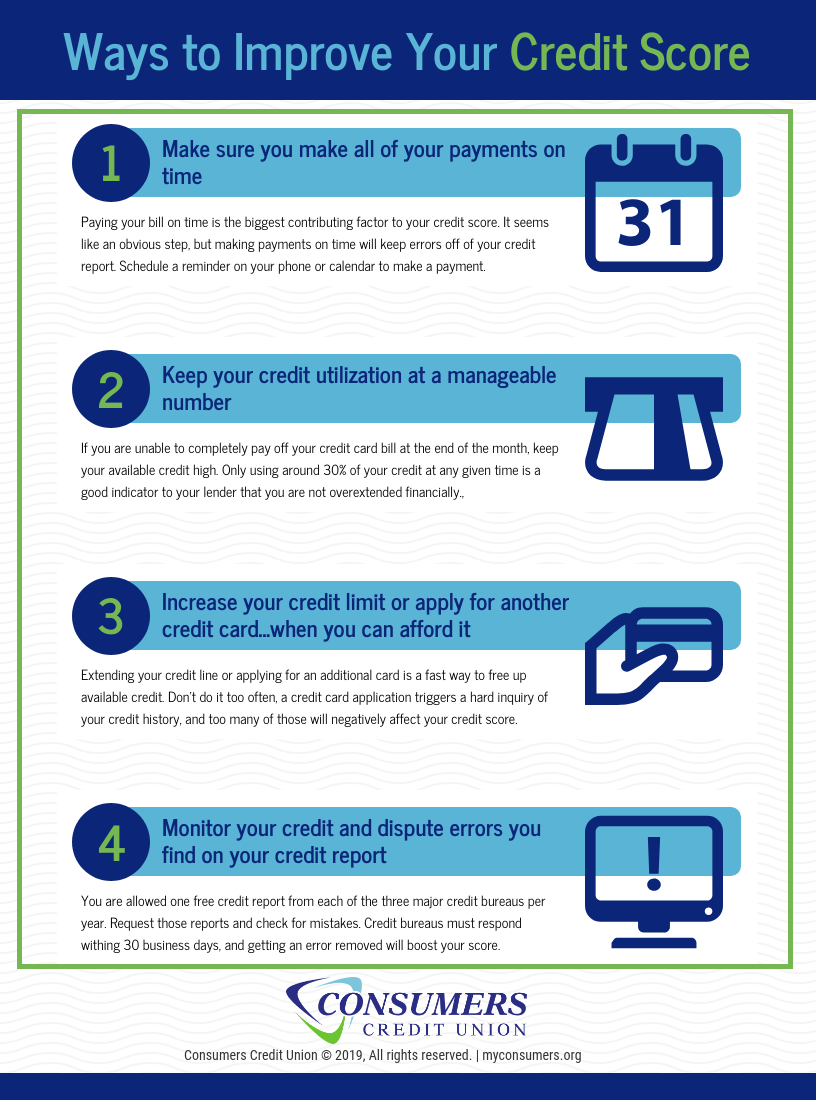

How to improve fica score. It is important to not misuse or overextend the credit you are given. But here are some things to consider that can help almost anyone boost their credit score: Advanced analytics & modeling cloud applications & services collections & debt recovery customer management credit decisioning credit profile reports data reporting & furnishing.

Make sure your credit reports are accurate the three leading credit reporting agencies—experian, transunion. To improve your payment history: Knowledge about any issues that may be holding your credit score back.

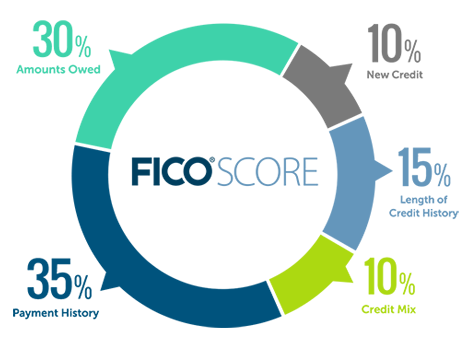

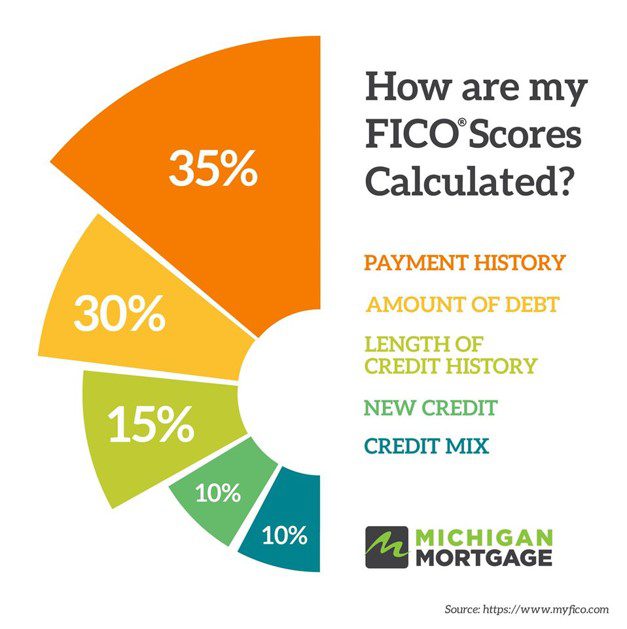

10 tips to improve your credit score. This will definitely negatively impact your credit score. Your payment history is the most important factor for your credit score.

That is, you should maintain a balance of no more than $3,000 on a credit card with a. Late payments more than 29 days will severely. Just make sure there’s money in your account to cover payments, or your credit.

Use your credit card to improve your credit score 3. Here are some tips on how you can improve your credit score: Keep a check on your credit report:

When looking to improve your credit score, a good first step is to review. Prove where you live register on the electoral roll at your current. Making regular payments by direct debit could also help to improve your credit score.