Beautiful Work Info About How To Avoid Bill Collectors

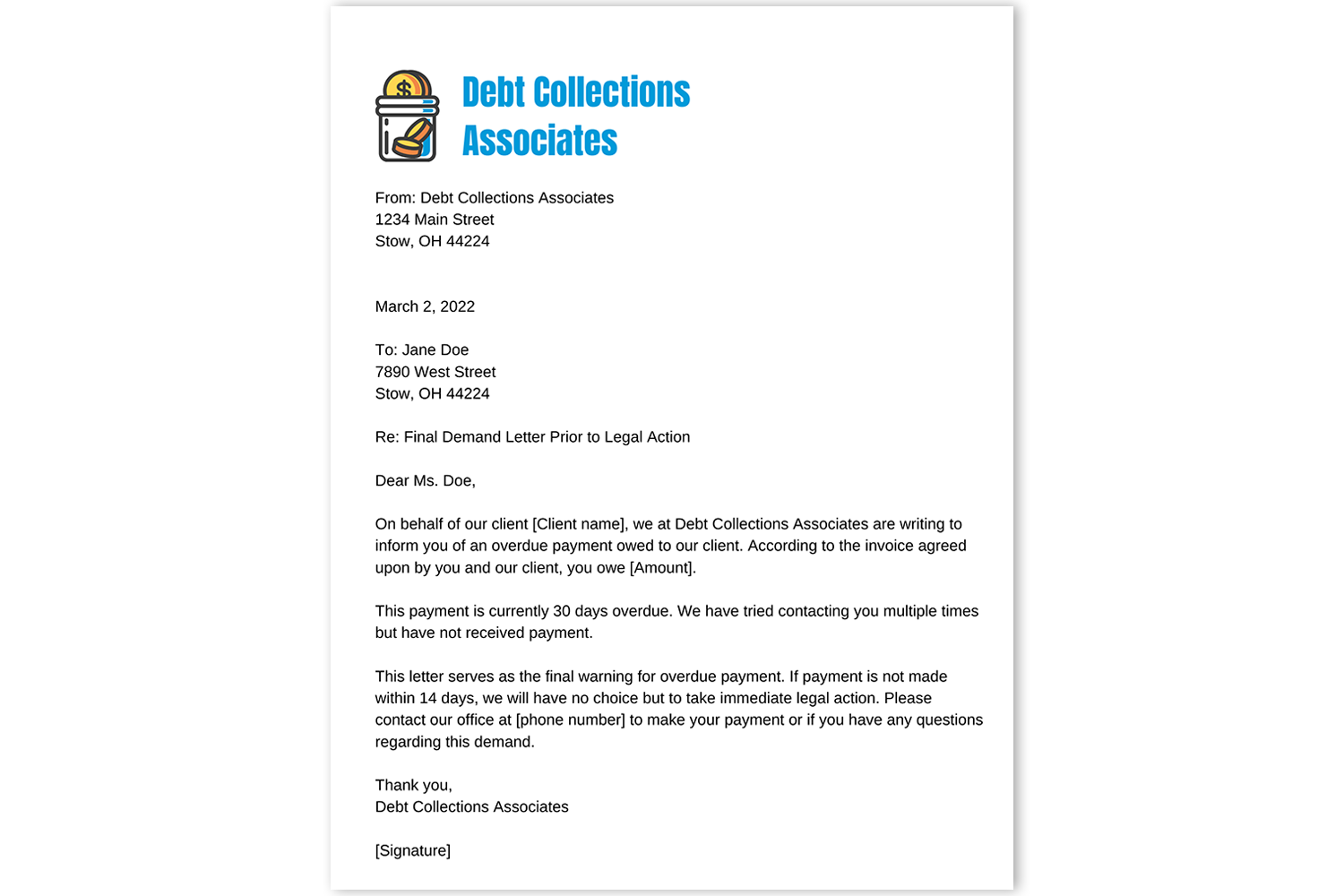

If the debt is for $1,000, offer $300 in full.

How to avoid bill collectors. By consumer publishing co., 1979, consumer pub. These methods give you a record of each payment, which you may need later on if a debt collector fails to record the payments. If the debt is yours and you can’t afford to pay it, you may be able to make arrangements with the debt.

Mistakes to avoid when dealing with debt collectors. Keep track of your expenses. They are causing you anxiety 3.

Sometimes you get into debt because you don’t realize where most of your money is going. Avoid giving a collection agency details about. How to know if a debt collector is a scam

In this blog post, i'm going to share 7 ways to avoid being sued by debt collectors so that you can live a more peaceful life without having to deal with their constant phone calls. Debt collection can be tricky, legally speaking. How to avoid bill collectors method 1 making yourself hard to find.

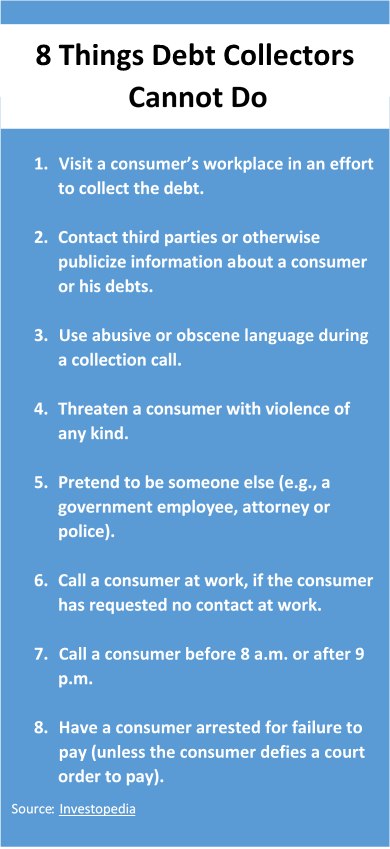

Never do that by the way. A collector has to give you “validation information” about the debt, either during their first phone call with. Strangers are not your friends!

Speak to the billing department. A collector has to give you “validation information” about the debt, either during their first phone call with you or in writing within five days after first contacting you. There are steps you can take to avoid dealing with debt collectors in your social media world.